Earn More Money With Acorns !

Acorns is a smart investment advisor that takes the concept of easy investing a step further by automatically investing users’ loose change. The platform has over 8 million members and offers an easy-to-use app, straightforward pricing and a feature-rich linked checking account.

Top Benefits

Emphasis on automation

All robo-advisors aim to make investing easy, but Acorns takes it a step further and automates it. Users link their other financial accounts (debit, checking, credit) to the Acorns app and purchases are rounded up to the nearest dollar. For example, if you spend $4.79 on coffee, Acorns will round it up and credit your investment account with $0.21. It is important to note that Acorns will take investment funds from an associated checking account even if you can connect a credit card.

Translated with www.DeepL.com/Translator (free version)

Easy to use application

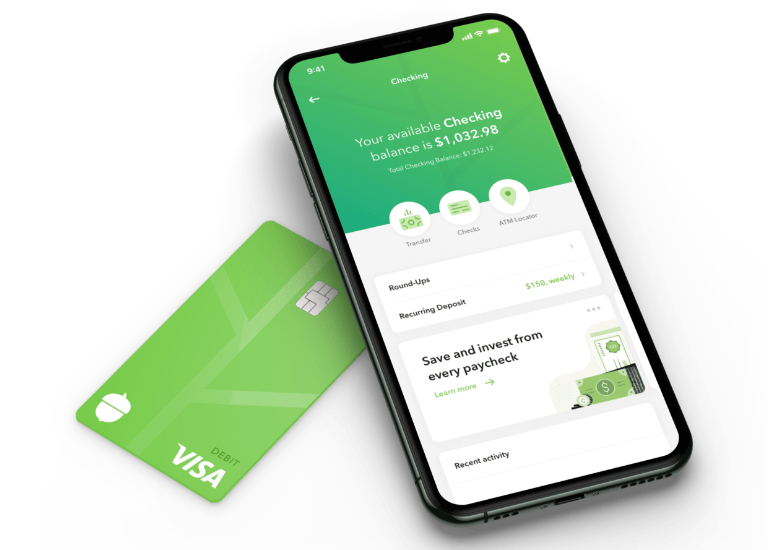

Acorns is an app-based investment platform. It has a user-friendly app with high ratings. In the Google Play store, the Acorns app has received 4.4 stars out of 5 based on over 133,000 user Acorns app review entries. On the App Store, you’ll find even higher Acorns app ratings (4.7 out of 5) based on 674,000 reviews.

Automatic rebalancing

Most robo-advisors rebalance their clients’ portfolios over time, and Acorns is no exception. In other words, once you select one of Acorns’ ready-made portfolio options, it automatically maintains the allocation you want.

Several account types

Acorns offers individual (taxable) investment accounts and IRAs (traditional, Roth and SEP). It also offers custodial accounts for children. It does not offer trusts, 529 accounts, simple IRAs, Solo 401(k) or co-investment accounts. However, the types of accounts offered should meet the needs of most investors.

Translated with www.DeepL.com/Translator (free version)

Direct Pricing

Most smart investment platforms charge a percentage of client assets (e.g., 0.25%) as their management fee. This can be difficult for many investors to fully understand. Acorns pricing includes a direct monthly management fee of $1, $3 or $5, depending on the level of account functionality. The monthly fee for the all-in-one Acorns application is a big differentiating factor.

Check Account Access

Acorns customers in both upgraded membership levels have access to the Acorns Spend checking account. The account offers Acorns debit cards, free withdrawals at more than 55,000 ATMs, mobile check deposits, and no overdraft fees. That’s a big difference. Most robo-advisors don’t offer checking accounts, so this is useful for investors who like to keep all their financial accounts in one place.

Easy Investing

Our general comment on Acorns Investing is that the process is very simple, as is the portfolio selection. Acorns has five portfolios to choose from, taking the guesswork out of the investment process. Unlike many competitors’ portfolios, they all have easy-to-understand headings, such as “aggressive” and “moderately conservative”. If you want more options, check out our best brokers for beginners. But for investors who want to keep things simple, Acorns does.

Partner Offers

Acorns offers a program for members called Found Money, which is a promotional platform similar to what most credit card companies offer. Only, instead of offering cash back for purchases through one of Acorns’ partners, Acorns credits the cash to the user’s investment account. For example, if you make a $100 purchase with one of Acorns’ partners, you might see a $20 cash offer for your investment.

What can be improved

No tax loss harvesting

Several other robo-advisors offer tax loss harvesting strategies. For investors with large balances in taxable investment accounts, these may be a major source of tax savings. Acorn does not offer this.

No human financial advisor

Some robo-advisors offer clients some level of access to a human financial advisor, but Acorns does not. If you want to get financial planning help from a real person, you’ll need to look elsewhere.

Fees (for small accounts)

While Acorns has a very simple fee structure, it can be quite expensive for investors with small account balances. Even with the Lite plan, the $12 annual management fee equates to 1.2% of a $1,000 balance. Most robo-advisors with percentage based fees do not charge anything close to this fee. However, the effective cost of administration decreases as the account grows and the amount becomes smaller each year. As a result, Acorns’ fee structure favors investors with larger balances. Acorns does not charge other fees for accounts under $1 million.

Acorns is suitable for you if the following conditions are met.

You want to automate your investments as much as possible.

You want a standard investment account, an IRA or a custodial account for your children.

You need a checking account that integrates with your investment accounts.

Your top priority is simplicity.